Preparing for the Collapse of the Petrodollar System

Download it here absolutely free >> .

Preparing for the Collapse of the Petrodollar System, Part 1

Recently, there have been many news headlines containing the words "Iran", "nuclear capability", "Syria", and "Islamic State". If you listen closely, you can almost hear the drumbeats of a fresh war in the Middle East.

As an economist, I have been trained to view the world through the lens of incentives. (I am a "bottom line" kind of guy.) And just as every action is motivated by an underlying incentive, every decision has a related consequence.

This brief article details the actions, incentives, and related consequences that the United States has created through its attempts to maintain global hegemony through something known as the petrodollar system.

This article will begin with a look back at the important events of the 1944 Bretton Woods Conference, which firmly established the U.S. Dollar as the global reserve currency. Then we will examine the events that led up to the 1971 Nixon Shock when the United States abandoned the international gold standard. We will then consider what may be the most brilliant economic and geopolitical strategy devised in recent memory, the petrodollar system. Finally, we conclude by examining the latest challenges facing U.S. economic policy around the globe and how the petrodollar system influences our foreign policy efforts in oil-rich nations. The collapse of the petrodollar system, which I believe will occur sometime within this decade, will make the 1971 Nixon Shock look like a dress rehearsal.

This article will begin with a look back at the important events of the 1944 Bretton Woods Conference, which firmly established the U.S. Dollar as the global reserve currency. Then we will examine the events that led up to the 1971 Nixon Shock when the United States abandoned the international gold standard. We will then consider what may be the most brilliant economic and geopolitical strategy devised in recent memory, the petrodollar system. Finally, we conclude by examining the latest challenges facing U.S. economic policy around the globe and how the petrodollar system influences our foreign policy efforts in oil-rich nations. The collapse of the petrodollar system, which I believe will occur sometime within this decade, will make the 1971 Nixon Shock look like a dress rehearsal.

If you have never heard of the petrodollar system, it will not surprise me. It is certainly not a topic that makes it's way out of Washington and Wall Street circles too often. The mainstream media rarely, if ever, discusses the inner workings of the petrodollar system and how it has motivated, and even guided, America's foreign policy in the Middle East for the last several decades.

Personal Note: What I am going to explain in this article is something that I believe is vitally important for every American to understand. Since 2006, I have written dozens of articles on the petrodollar system. I have appeared on many major news media outlets talking about the petrodollar system. I even wrote a best-selling book entitled Bankruptcy of our Nation that spent an entire chapter exposing the petrodollar system. I have spoken about this topic all over the world. Suffice it to say, I believe that understanding the petrodollar system is very important to your financial well being. I encourage you to print this article out and read it carefully. When you are finished with it, I encourage you to share it with your friends and neighbors. Share it on Facebook and Twitter. Help us get the word out so that the American public can stir from its slumber and begin preparing for what lies ahead.

A Brief Overview of this Article Series on the Petrodollar System

In the final days of World War II, 44 leaders from all of the Allied nations met in Bretton Woods, New Hampshire in an effort to create a new global economic order. With much of the global economy decimated by the war, the United States emerged as the world's new economic leader. The relatively young and economically nimble U.S. served as a refreshing replacement to the globe's former hegemon: a debt-ridden and war-torn Great Britain.

In the final days of World War II, 44 leaders from all of the Allied nations met in Bretton Woods, New Hampshire in an effort to create a new global economic order. With much of the global economy decimated by the war, the United States emerged as the world's new economic leader. The relatively young and economically nimble U.S. served as a refreshing replacement to the globe's former hegemon: a debt-ridden and war-torn Great Britain.

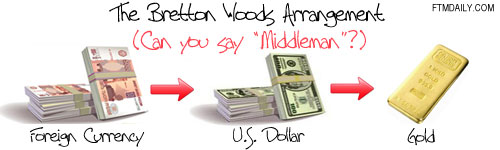

In addition to introducing a number of global financial agencies, the historic meeting also created an international gold-backed monetary standard which relied heavily upon the U.S. Dollar.

Initially, this dollar system worked well. However, by the 1960's, the weight of the system upon the United States became unbearable. On August 15, 1971, President Richard M. Nixon shocked the global economy when he officially ended the international convertibility from U.S. dollars into gold, thereby bringing an official end to the Bretton Woods arrangement.

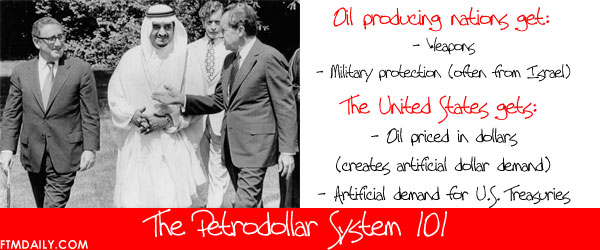

Two years later, in an effort to maintain global demand for U.S. dollars, another system was created called the petrodollar system. In 1973, a deal was struck between Saudi Arabia and the United States in which every barrel of oil purchased from the Saudis would be denominated in U.S. dollars. Under this new arrangement, any country that sought to purchase oil from Saudi Arabia would be required to first exchange their own national currency for U.S. dollars. In exchange for Saudi Arabia's willingness to denominate their oil sales exclusively in U.S. dollars, the United States offered weapons and protection of their oil fields from neighboring nations, including Israel.

Two years later, in an effort to maintain global demand for U.S. dollars, another system was created called the petrodollar system. In 1973, a deal was struck between Saudi Arabia and the United States in which every barrel of oil purchased from the Saudis would be denominated in U.S. dollars. Under this new arrangement, any country that sought to purchase oil from Saudi Arabia would be required to first exchange their own national currency for U.S. dollars. In exchange for Saudi Arabia's willingness to denominate their oil sales exclusively in U.S. dollars, the United States offered weapons and protection of their oil fields from neighboring nations, including Israel.

By 1975, all of the OPEC nations had agreed to price their own oil supplies exclusively in U.S. dollars in exchange for weapons and military protection.

This petrodollar system, or more simply known as an "oil for dollars" system, created an immediate artificial demand for U.S. dollars around the globe. And of course, as global oil demand increased, so did the demand for U.S. dollars.

As the U.S. dollar continued to lose purchasing power, several oil-producing countries began to question the wisdom of accepting increasingly worthless paper currency for their oil supplies. Today, several countries have attempted to move away, or already have moved away, from the petrodollar system. Examples include Iran, Syria, Venezuela, and North Korea… or the "axis of evil," if you prefer. (What is happening in our world today makes a whole lot of sense if you simply read between the lines and ignore the "official" reasons that are given in the mainstream media.) Additionally, other nations are choosing to use their own currencies for oil like China, Russia, and India, among others.

As more countries continue to move away from the petrodollar system which uses the U.S. dollar as payment for oil, we expect massive inflationary pressures to strike the U.S. economy. In this article, we will explain how this could be possible.

The Coming Collapse of the Petrodollar System

When historians write about the year 1944, it is often dominated with references to the tragedies and triumphs of World War II. And while 1944 was truly a pivotal year in one of history's most devastating conflicts of all time, it was also a significant year for the international economic system. In July of that same year, the United Nations Monetary and Financial Conference (more commonly known as the Bretton Woods conference) was held in the Mount Washington hotel in Bretton Woods, New Hampshire. The historic gathering included 730 delegates from 44 Allied nations. The aim of the meeting was to regulate the war-torn international economic system.

During the three-week conference, two new international bodies were established.

These included:

- The International Bank of Reconstruction and Development (IBRD, later known as the World Bank)

- The International Monetary Fund

In addition, the delegates introduced the General Agreement on Tariffs and Trade (GATT, later known as the World Trade Organization, or WTO.)

More importantly, for our purposes here, another development that emerged from the conference was a new fixed exchange rate regime with the U.S. Dollar playing a central role. In essence, all global currencies were pegged to the U.S. Dollar.

At this point, an appropriate question to be asking yourself is: ''Why would all of the nations be willing to allow the value of their currencies to be dependent upon the U.S. Dollar?"

The answer is quite simple.

The U.S. Dollar would be pegged at a fixed rate to gold. This made the U.S. dollar completely convertible into gold at a fixed rate of $35 per ounce within the global economic community. This international convertibility into gold allayed concerns about the fixed rate regime and created a sense of financial security among nations in pegging their currency's value to the dollar. After all, the Bretton Woods arrangement provided an escape hatch: if a particular nation no longer felt comfortable with the dollar, they could easily convert their dollars holdings into gold. This arrangement helped restore a much-needed stability in the financial system. But it also accomplished one other very important thing. The Bretton Woods agreement instantly created a strong global demand for U.S. dollars as the preferred medium of exchange.

And along with this growing demand for U.S. Dollars came the need for… a larger supply of dollars.

Now, before we continue this discussion, stop for a moment and ask yourself this question: Are there any obvious benefits from creating more dollars? And if so, who benefits?

First, the creation of more dollars allows for the inflation of asset prices. In other words, more dollars in existence allows for a rise in overall prices.

For example, imagine for a moment if the U.S. economy had a total money supply of only $1 million dollars. What if, in this imaginary economy, I attempted to sell you my home for $2 million dollars? While you may like my home, and may even want to buy it, it would be physically impossible for you to do so. And it would be completely absurd for me to ask for $2 million because, in our imaginary economy, there is only $1 million in existence.

For example, imagine for a moment if the U.S. economy had a total money supply of only $1 million dollars. What if, in this imaginary economy, I attempted to sell you my home for $2 million dollars? While you may like my home, and may even want to buy it, it would be physically impossible for you to do so. And it would be completely absurd for me to ask for $2 million because, in our imaginary economy, there is only $1 million in existence.

So an increase in the overall money supply allows asset prices to rise.

But that's not all.

The United States government benefits from a global demand for U.S. dollars. How? It's because a global demand for dollars gives the Federal government a "permission slip" to print more. After all, we can't let our global friends down, can we? If they "need" dollars, then let's print some more dollars for them.

Is it a coincidence that printing dollars is the U.S. government's preferred method of dealing with our nation's economic problems?

Remember, Washington only has four basic ways to solve its economic problems:

1. Increase income by raising taxes on the citizens

2. Cut spending by reducing benefits

3. Borrow money through the issuance of government bonds

4. Print money

Raising taxes and making meaningful spending cuts can be political suicide. Borrowing money is a politically convenient option, but you can only borrow so much. That leaves the final option of printing money. Printing money requires no immediate sacrifice and no spending cuts. It's a perfect solution for a growing country that wants to avoid making any sacrifices. However, printing more money than is needed can lead to inflation. Therefore, if a country can somehow generate a global demand for its currency, it has a "permission slip" to print more money. Understanding this "permission slip" concept will be important as we continue.

Finally, the primary beneficiary of an increased global demand for the U.S. Dollar is America's central bank, the Federal Reserve. If this does not make immediate sense, then pull out a dollar bill from your wallet or purse and notice whose name is plastered right on the top of it.

Have you ever asked yourself why the U.S. Dollar is called a Federal Reserve Note?

Once again, the answer is simple.

The U.S. Dollar is issued and loaned to the United States government by the Federal Reserve.

Because our dollars are loaned to our government by the Federal Reserve, which is a private central banking cartel, the dollars must be paid back. And not only must the dollars be paid back to the Federal Reserve. They must be paid back with interest!

And who sets the interest rate targets on the loaned dollars? It's the Federal Reserve, of course.

To put it simply, the Federal Reserve has a clear vested interest in maintaining a stable and growing global demand for U.S. Dollars because they create them and then earn profit from them with interest rates which they set themselves. What a great system the Federal Reserve has for itself. No wonder it hates oversight and intervention. No wonder the private banking cartel that runs the Federal Reserve despises all attempts to actually audit its books.

In summary, the American consumer, the Federal government, and Federal Reserve all benefit to varying degrees from a global demand for U.S. Dollars.

The Bretton Woods Breakdown: Vietnam, The Great Society, and Deficit Spending

There is an old saying that goes, "He who holds the gold makes the rules." This statement has never been truer than in the case of America in the post–World War II era. By the end of the war, nearly 80 percent of the world's gold was sitting in U.S. vaults, and the U.S. Dollar had officially become the world's undisputed reserve currency.

There is an old saying that goes, "He who holds the gold makes the rules." This statement has never been truer than in the case of America in the post–World War II era. By the end of the war, nearly 80 percent of the world's gold was sitting in U.S. vaults, and the U.S. Dollar had officially become the world's undisputed reserve currency.

As a result of the Bretton Woods arrangement, the dollar was considered to be "as safe as gold."

A study of the United States economy in the post-World War II era demonstrates that this was a time of dramatic economic growth and expansion. This era gave rise to the baby boomer generation. By the late 1960's, however, the American economy was under major pressure. Deficit spending in Washington was uncontrollable as President Lyndon B. Johnson began to realize his dream of a "Great Society." With the creation of Medicare and Medicaid, American citizens could now, for the first time, earn a living from their government.

Meanwhile, an expensive and unpopular war in Vietnam funded by record deficit spending led some nations to question the economic underpinnings of America.

After all, the entire global economic order had become dependent upon a sound U.S. economy. Countries like Japan, Germany, and France, while fully on the mend from the devastation of World War II, were still largely dependent upon a financially stable American economy to maintain their economic growth.

By 1971, as America's trade deficits increased and its domestic spending soared, the perceived economic stability of Washington was being publicly challenged by many nations around the globe. Foreign nations could sense the severe economic difficulties mounting in Washington as the United States was under financial pressure at home and abroad. According to most estimates, the Vietnam War had a price tag in excess of $200 billion. This mounting debt, plus other debts incurred through a series of poor fiscal and monetary policies, was highly problematic given America's global monetary role.

But it was not America's financial issues that most concerned the international economic community. Instead, it was the growing imbalance of U.S. gold reserves to debt levels that was most alarming.

The United States had accumulated large amounts of new debt but did not have the money to pay for them. Making matters worse, U.S. gold reserves were at all-time lows as nation after nation began requesting gold in exchange for their dollar holdings. It was almost as if foreign nations could see the writing on the wall for the end of the Bretton Woods arrangement.

As 1971 progressed, so did foreign demand for U.S. gold. Foreign central banks began cashing in their excess dollars in exchange for the safety of gold. As nations lined up to exchange their dollar holdings for Washington's gold, the United States realized that the game was over. Clearly, America had never intended to be the globe's gold warehouse. Instead, the convertibility of the dollar into gold was meant to generate a global trust in U.S. paper money. Simply knowing that the U.S. dollar could be converted into gold if necessary was good enough for some — but not for everyone. The nations which began to doubt America's ability to manage their own finances decided to opt for the recognized safety of gold. (Historically, gold has been, and will likely remain, the beneficiary of poor fiscal and monetary policies, and 1971 was no different.)

As 1971 progressed, so did foreign demand for U.S. gold. Foreign central banks began cashing in their excess dollars in exchange for the safety of gold. As nations lined up to exchange their dollar holdings for Washington's gold, the United States realized that the game was over. Clearly, America had never intended to be the globe's gold warehouse. Instead, the convertibility of the dollar into gold was meant to generate a global trust in U.S. paper money. Simply knowing that the U.S. dollar could be converted into gold if necessary was good enough for some — but not for everyone. The nations which began to doubt America's ability to manage their own finances decided to opt for the recognized safety of gold. (Historically, gold has been, and will likely remain, the beneficiary of poor fiscal and monetary policies, and 1971 was no different.)

One would have expected that the large and growing demand by foreign nations for gold instead of dollars would have been a strong indicator to the United States to get its fiscal house in order. Instead, America did exactly the opposite. As Washington continued racking up enormous debts to fund its imperial pursuits and its over-consumption, foreign nations sped up their demand for more U.S. gold and fewer U.S. dollars. Washington was caught in its own trap and was required to supply real money (gold) in return for the inflows of their fake paper money (U.S. dollars).

They had been hamstrung by their own imperialistic policies.

Soon the United States was bleeding gold. Washington knew that the system was no longer viable, and certainly not sustainable. But what could they do to stem the crisis? There were only two options.

The first option would require that Washington immediately reduce its massive spending and dramatically reduce its existing debts. This option could possibly restore confidence in the long-term viability of the U.S. economy. The second option would be to increase the dollar price of gold to accurately reflect the new economic realities. There was an inherent flaw in both of these options that made them unacceptable to the United States at the time… they both required fiscal restraint and economic responsibility. Then, as now, there was very little appetite for reducing consumption in the beleaguered name of "sacrifice" or "responsibility."

Goodbye, Yellow Brick Road

The Bretton Woods system created an international gold standard with the U.S. dollar as the ultimate beneficiary. But in an ironic twist of fate, the system that was designed to bring stability to a war-torn global economy was threatening to plunge the world back into financial chaos. The gold standard created by Bretton Woods simply could not bear the financial excesses, coupled with the imperialistic pursuits, of the American economic empire.

On August 15, 1971, under the leadership of President Richard M. Nixon, Washington chose to maintain its reckless consumption and debt patterns by detaching the U.S. Dollar from its convertibility into gold. By "closing the gold window," Nixon destroyed the final vestiges of the international gold standard. Nixon's decision effectively ended the practice of exchanging dollars for gold, as directed under the Bretton Woods agreement. It was in this year, 1971, that the U.S. dollar officially abandoned the gold standard and was declared a purely "fiat" currency. (A "fiat" currency is one that derives it value from its sponsoring government. It is a currency issued and accepted by decree.)

Here's a brief 2-minute excerpt of the actual televised speech delivered by President Nixon on August 15, 1971 in which he ended the U.S. Dollar's convertibility into gold.

As all other fiat empires before it, Washington had come to view gold as a constraint to their colossal spending urges. A gold standard, as provided by the Bretton Woods system, meant that America had to attempt to publicly demonstrate fiscal restraint by maintaining holistic economic balance.

By "closing the gold window," Washington had affected not only American economic policy — it also affected global economic policy. Under the international gold standard of Bretton Woods, all currencies derived their value from the value of the dollar. And the dollar derived its value from the fixed price of its gold reserves. But when the dollar's value was detached from gold, it became what economists call a "floating" currency. (By "floating," it is meant that the currency is not attached, nor does it derive its value, from anything externally.) Put simply, a "floating" currency is a currency that is not fixed in value.

Like any commodity, the dollar could be affected by the market forces of supply and demand. When the dollar became a "floating" currency, the rest of the world's currencies, which had been previously fixed to the dollar, suddenly became "floating" currencies as well. (Note: It did not take long for this new system of floating currencies with floating exchange rates to attract manipulation by speculators and hedge funds. Currency speculation is and remains, a threat to floating currencies. Proponents of a single global currency use the current manipulation of currency speculators to promote their agenda.)

Like any commodity, the dollar could be affected by the market forces of supply and demand. When the dollar became a "floating" currency, the rest of the world's currencies, which had been previously fixed to the dollar, suddenly became "floating" currencies as well. (Note: It did not take long for this new system of floating currencies with floating exchange rates to attract manipulation by speculators and hedge funds. Currency speculation is and remains, a threat to floating currencies. Proponents of a single global currency use the current manipulation of currency speculators to promote their agenda.)

In this new era of floating currencies, the U.S. Federal Reserve, America's central bank, had finally freed itself from the constraint of a gold standard. Now, the U.S. dollar could be printed at will — without the fear of not having enough gold reserves to back up new currency production. And while this new-found monetary freedom would alleviate pressure on America's gold reserves, there were other concerns.

One major concern that Washington had was regarding the potential shift in global demand for the U.S. dollar. With the dollar no longer convertible into gold, would demand for the dollar by foreign nations remain the same, or would it fall?

The second concern had to do with America's extravagant spending habits. Under the international gold standard of Bretton Woods, foreign nations gladly held U.S. debt securities, as they were denominated in gold-backed U.S. dollars. Would foreign nations still be eager to hold America's debts despite the fact that these debts were denominated in a fiat debt-based currency that was backed by nothing?

(In part two of this four part series, I will continue this article with an in-depth look at the solution that President Nixon and his Secretary of State, Henry Kissinger, developed to prevent a continual decrease in global dollar demand. The ingenuity of this plan is breathtaking in scope. It is known as the Petrodollar system.)

Once you understand this "dollars for oil" arrangement, I believe that it will provide you with a more accurate understanding of what motivates America's foreign policy

This article series is an excerpt from Jerry Robinson's groundbreaking book, Bankruptcy of our Nation: Your Financial Survival Guide. Get it in paperback or on Kindle today!

TAGS: the petrodollar system, petrodollars, bretton woods, nixon shock, dollar collapse

Download it here absolutely free >> .

Preparing for the Collapse of the Petrodollar System, Part 2

The Rise of the Petrodollar System: "Dollars for Oil"

by Jerry Robinson

(Miss Part One? Start here.)

| Introduction to Part Two |

|---|

In part one of this four part article series, I provided a background to our modern petrodollar system by explaining the "dollars for gold" arrangement that was put in place by global leaders through the Bretton Woods conference in the final days of World War II. The article provided a brief evolution of the Bretton Woods agreement from its inception in 1944 to its ultimate demise in 1971. As detailed, in the late 1960's, this "dollars for gold" system had become unsustainable as Washington insisted upon the adoption of a "welfare state" that relied upon massive entitlements and a "warfare state" that required perpetual wars. In the second installment of this article series, I will further explain the circumstances surrounding the demise of this failed "dollars for gold" arrangement, with a particular emphasis on how its demise dealt a major blow to global dollar demand. I will detail how the Washington elites sought to replace the lost global dollar demand that had been artificially created through the Bretton Woods system. Their solution would come in the form of something known as the Petrodollar system. The three primary benefits that the Petrodollar system provides to America will be explained. And finally, the article will conclude with a brief examination of how the Petrodollar system has influenced U.S.-Middle East relations with a specific focus on Israel. |

The Same Game with a New Name: "Dollars for Oil" Replaces "Dollars for Gold"

In the early 1970s, the final vestiges of the international gold-backed dollar standard, known as the Bretton Woods arrangement, had collapsed. Many foreign nations who had previously agreed to a gold-backed dollar as the global reserve currency were now having serious mixed feelings about the arrangement. Nations like Britain, France, and Germany determined that a cash-strapped and debt-crazed United States was in no financial shape to be leading the global economy. These were just a few of the many nations which began demanding gold in exchange for their dollars.

In the early 1970s, the final vestiges of the international gold-backed dollar standard, known as the Bretton Woods arrangement, had collapsed. Many foreign nations who had previously agreed to a gold-backed dollar as the global reserve currency were now having serious mixed feelings about the arrangement. Nations like Britain, France, and Germany determined that a cash-strapped and debt-crazed United States was in no financial shape to be leading the global economy. These were just a few of the many nations which began demanding gold in exchange for their dollars.

Despite pressure from foreign nations to protect the dollar's value by reining in excessive government spending, Washington displayed little fiscal constraint and continued to live far beyond its means. It had become obvious to all that America lacked the basic fiscal discipline which could prevent the destruction of its own currency.

Like previous governments before it, America had figured out how to "game" the global reserve currency system for its own benefit, leaving foreign nations in an economically vulnerable position. After America and its citizens had tasted the sweet fruit of excessive living at the expense of other nations, the party was over.

It is unfair, however, to say that the Washington elites were blind to the deep economic issues confronting it in the late 1960's and early 1970's. Washington knew that the "dollars for gold" had become completely unsustainable. But instead of seeking solutions to the global economic imbalances that had been created by America's excessive deficits, Washington's primary concern was how to gain an even greater stranglehold on the global economy.

In order to ensure their economic hegemony, and thereby preserve an increasing demand for the dollar, the Washington elites needed a plan. In order for this plan to succeed, it would require that the artificial dollar demand that had been lost in the wake of the Bretton Woods collapse be replaced through some other mechanism.

According to John Perkins, the author of Confessions of an Economic Hit Man: The Shocking Story of How America Really Took Over the World, that plan came in the form of the petrodollar system.

(Click here to listen to Jerry Robinson's interview with John Perkins.)

But what exactly is the petrodollar system?

First, let's define what a petrodollar is.

A petrodollar is a U.S. dollar that is received by an oil producer in exchange for selling oil, and that is then deposited into Western banks.

Despite the seeming simplicity of this arrangement of "dollars for oil," the petrodollar system is actually highly complex and one with many moving parts. It is this complexity that prevents the petrodollar system from being properly understood by the American public.

Allow me to provide a very basic overview regarding the history and the mechanics of the petrodollar system.

It is my belief that once you understand this "dollars for oil"arrangement, you will gain a more accurate understanding of what motivates America's economic (and especially foreign) policy.

So, let's take a closer look…

The Rise of the Petrodollar System

The petrodollar system originated in the early 1970s in the wake of the Bretton Woods collapse.

President Richard M. Nixon and his globalist sidekick, Secretary of State, Henry Kissinger, knew that their destruction of the international gold standard under the Bretton Woods arrangement would cause a decline in the artificial global demand for the U.S. dollar. Maintaining this "artificial dollar demand" was vital if the United States were to continue expanding its "welfare and warfare" spending.

President Richard M. Nixon and his globalist sidekick, Secretary of State, Henry Kissinger, knew that their destruction of the international gold standard under the Bretton Woods arrangement would cause a decline in the artificial global demand for the U.S. dollar. Maintaining this "artificial dollar demand" was vital if the United States were to continue expanding its "welfare and warfare" spending.

In a series of meetings, the United States — represented by then U.S. Secretary of State Henry Kissinger — and the Saudi royal family made a powerful agreement. (Several authors have worked to compile data on the origins of the petrodollar system, some exhaustively, including Richard Duncan, William R. Clark, David E. Spiro, Charles Goyette and F. William Engdahl).

According to the agreement, the United States would offer military protection for Saudi Arabia's oil fields. The U.S. also agreed to provide the Saudis with weapons, and perhaps most importantly, guaranteed protection from Israel.

The Saudi royal family knew a good deal when they saw one. They were more than happy to accept American weapons and a U.S. guarantee to restrain attacks from neighboring Israel.

Naturally, the Saudis wondered how much all of this U.S. military muscle was going to cost…

What exactly did the United States want in exchange for their weapons and military protection?

The Americans laid out their terms. They were simple and two-fold.

1) The Saudis must agree to price all of their oil sales in U.S. dollars only. (In other words, the Saudis were to refuse all other currencies except the U.S. dollar as payment for their oil exports.)

2) The Saudis would be open to investing their surplus oil proceeds in U.S. debt securities.

You can almost hear one of the Saudi officials in a meeting saying: "Really? That's all? You don't want any of our money or our oil? You just want to tell us how to price our oil and then you will give us weapons, military support, and guaranteed protection from our enemy, Israel? You've got a deal!"

However, the U.S. had done its economic homework. If they could get the Saudis to buy into this deal, it would be enough to launch them into the economic stratosphere in the coming decades.

Fast forward to 1974 when the petrodollar system was fully operational in Saudi Arabia.

And just as the United States had cleverly calculated, it did not take long before other oil-producing nations wanted in on the deal.

By 1975, all of the oil-producing nations of OPEC had agreed to price their oil in dollars and to hold their surplus oil proceeds in U.S. government debt securities in exchange for the generous offers by the U.S.

Just dangle weapons, military aid, and guaranteed protection from Israel in front of third world, oil-rich, Middle East nations… and let the bidding begin.

Nixon and Kissinger had successfully bridged the gap between the failed Bretton Woods arrangement and the new Petrodollar system. The global artificial demand for U.S. dollars would not only remain intact, it would soar due to the increasing demand for oil around the world.

And from the perspective of empire, this new "dollars for oil" system was much more preferred over the former "dollars for gold" system as its economic requirements were much less stringent. Without the constraints imposed by a rigid gold standard, the U.S. monetary base could be grown at exponential rates.

It should come as no surprise that the United States maintains a major military presence in much of the Persian Gulf region, including the following countries: Bahrain, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates, Egypt, Israel, Jordan, and Yemen.

The truth is easy to find when you follow the money…

The Petrodollar System Encourages Cheap Exports to the United States

While the U.S./Saudi agreement may have smelled of desperation at a time of decreasing global dollar demand, it can now be considered one of the most brilliant geopolitical and economic strategies in recent political memory.

Today, virtually all global oil transactions are settled in U.S. dollars. (There are a few exceptions and they will be highlighted in our next article appropriately titled, The Petrodollar Wars.) When a country does not have a surplus of U.S. dollars, it must create a strategy to obtain them in order to buy oil.

The easiest way to obtain U.S. dollars is through the foreign exchange markets. This is not, however, a viable long-term solution as it is cost-prohibitive. Therefore, many countries have opted instead to develop an export-led strategy with the United States in order to exchange their goods and services for the U.S. dollars that they need to purchase oil in the global markets. (This should help explain much of East Asia's export-led strategy since the 1980's.) Japan, for example, is an island nation with very few natural resources. It must import large amounts of commodities, including oil, which requires U.S. dollars. So Japan manufactures a Honda and ships it to the United States and immediately receives payment in U.S. dollars.

The easiest way to obtain U.S. dollars is through the foreign exchange markets. This is not, however, a viable long-term solution as it is cost-prohibitive. Therefore, many countries have opted instead to develop an export-led strategy with the United States in order to exchange their goods and services for the U.S. dollars that they need to purchase oil in the global markets. (This should help explain much of East Asia's export-led strategy since the 1980's.) Japan, for example, is an island nation with very few natural resources. It must import large amounts of commodities, including oil, which requires U.S. dollars. So Japan manufactures a Honda and ships it to the United States and immediately receives payment in U.S. dollars.

Problem solved… and export-led strategy explained.

The Primary Benefits of the Petrodollar System

The petrodollar system has proven tremendously beneficial to the U.S. economy. In addition to creating a marketplace for affordable imported goods from countries who need U.S. dollars, there are more specific benefits.

In essence, America receives a double loan out of every global oil transaction.

First, oil consumers are required to purchase oil in U.S. dollars.

Second, the excess profits of the oil-producing nations are then placed into U.S. government debt securities held in Western banks.

The petrodollar system provides at least three immediate benefits to the United States.

- It increases global demand for U.S. dollars

- It increases global demand for U.S. debt securities

- It gives the United States the ability to buy oil with a currency it can print at will

Let's briefly examine each one of these benefits.

1. The petrodollar system increases global dollar demand.

Why is consistent global demand for the dollar a benefit? In many ways, currencies are just like any other commodity: the more demand that exists for the currency, the better it is for the producer.

| HAMBURGERS, PERMISSION SLIPS, AND THE PETRODOLLAR |

|---|

To help illustrate this point, let's imagine that you decided to open a hamburger stand in a small town with a population of 50,000. Of course, not everyone likes Now, as an owner of a hamburger stand in a very small town, would you prefer to have demand for hamburgers from your own town only… or would you like to have hamburger demand from other nearby towns and communities too? (My guess is that you would like to have more customers, as that potentially means more money in your pocket.) Now, let's take it a step further with another question… Would you rather have demand for your burgers from your own town and nearby communities only… or would you prefer to have all of the hamburger demand in your entire state? Once again, the answer should be obvious. Every good business understands that increasing consumer demand is a good thing for their company's bottom line. To put it another way, if consumers all over your state are demanding your burgers, you have just been given a permission slip to hire more burger flippers so that you can produce more burgers. (This concept of a demand-based permission slip is important so keep it under your hat for a moment.) Okay, now allow me to go even one ridiculous step further…

It doesn't take an economist to figure out what is going to happen to the demand for your burgers… it is going to skyrocket. Your hamburger demand is now global. Congratulations! As the demand for your hamburgers increases dramatically, so too the supply must increase. Your newfound global hamburger demand has given you a "permission slip" to buy even more frozen patties and hire new fry cooks. The important concept here is that a growing demand "permits" the producer to increase his supply. Now, let's conclude our hamburger illustration by imagining that an up and coming rival hamburger company becomes a major competitor with your hamburger restaurant chain. As many of your customers begin visiting your new competitor, the demand for your hamburgers begins to wane. As the demand for your burgers drops, you no longer have a "permission slip" to buy as many frozen patties as you did before. As demand for your burgers continues to fall, it makes little sense to hire more workers. Instead, to remain competitive, you must lay off workers and buy fewer frozen patties just to keep your company afloat. Furthermore, you may even need to sell your existing burgers at a discount before they spoil. If you decided to ignore the warning signs and continue hiring new employees and buying more patties than were actually demanded by your customers, you would soon find your company nearing bankruptcy. At some point, logic would dictate that you must decrease your supply. ____________________________________________ How it all applies to the U.S. Dollar: Now let's apply the same economic logic that we used to explain the increasing and decreasing demand for your hamburgers to the global demand for U.S. dollars. If it is only Americans who "demand" U.S. dollars, then the supply of dollars that Washington and the Federal Reserve can "supply", or create, is limited to our own country's demand. However, if Washington can somehow create a growing global demand for its paper dollars, then it has given itself a "permission slip" to continually increase the supply of dollars.

And, of course, the Federal Reserve's printing presses stood ready to meet this growing dollar demand with freshly printed U.S. dollars. After all, what kind of central bank would the Federal Reserve be if they were not ready to keep our dollar supply at a level consistent with the growing global demand? FACT: The artificial dollar demand created by the petrodollar system returned to Washington the "permission slip" to supply the global economy with freshly printed dollars that it lost after the demise of the Bretton Woods agreement.

And with so many dollars floating around the globe, America's asset prices (including houses, stocks, etc.) naturally rose. After all, as we have already demonstrated, prices are directly related to the available money supply. With this in mind, it is easy to see why maintaining a global demand for dollars is vital to our national "illusion of prosperity" and our "national security." (The lengths at which America has already gone to protect the petrodollar system will be explained in our third article of this series.) When, not if, the petrodollar system collapses, America will lose its "permission slip" to print excessive numbers of U.S. dollars.

When hyperinflation strikes America, it will be very difficult to stop without drastic measures. One possible measure will be a quick and massive reduction in the overall supply of U.S. dollars. However, with a reduction of the supply of dollars will come a massive reduction in the value of assets currently denominated in U.S. dollars. (I will explain more about potential scenarios of the petrodollar collapse along with personal strategies that you can take in the fourth and final article in this series.) |

2. The petrodollar system increases demand for U.S. debt securities

One of the most brilliant aspects of the petrodollar system was requesting that oil producing nations take their excess oil profits and place them into U.S. debt securities in Western banks. This system would later become known as "petrodollar recycling" as coined by Henry Kissinger. Through their exclusive use of dollars for oil transactions, and then depositing their excess profits into American debt securities, the petrodollar system is a "dream come true" for a spendthrift government like the United States.

One of the most brilliant aspects of the petrodollar system was requesting that oil producing nations take their excess oil profits and place them into U.S. debt securities in Western banks. This system would later become known as "petrodollar recycling" as coined by Henry Kissinger. Through their exclusive use of dollars for oil transactions, and then depositing their excess profits into American debt securities, the petrodollar system is a "dream come true" for a spendthrift government like the United States.

Despite its obvious benefits, the petrodollar recycling process is both unusual and unsustainable. It has served to distort the true demand for government debt that has "permitted" the U.S. government to maintain artificially low interest rates. Washington has become dependent upon these artificially low interest rates and, therefore, have a vested interest in maintaining them through any means necessary. The massive economic distortions and imbalances generated by the petrodollar system will eventually self-correct when the artificial dollar and U.S. debt demand is removed.

That day is coming.

3. The petrodollar system allows the U.S. to buy oil with a currency it can print at will

The third major benefit of the petrodollar system for the U.S. has to do with the actual purchase of oil itself.

Like all modern developed economies, the United States has built most of its infrastructures around the use of petroleum-based energy supplies. And like many nations, the U.S. consumes more oil each year than it can produce on its own. Therefore, it has become dependent upon foreign nations to fill the supply gap. What makes America different, however, is that it can pay for 100% of its oil imports with its own currency.

Again, it does not take much economic knowledge to figure out that this is a great deal.

Let's use another quick example.

Imagine that you and I both live in an unusual city where the only method of payment for gasoline for our automobiles is carrots.

Imagine that you and I both live in an unusual city where the only method of payment for gasoline for our automobiles is carrots.

Now, imagine that I own the exclusive rights in our town to grow carrots, and I have the only existing carrot farm in our town. For you, this means that in order to buy any gasoline, you must first deal with me. You can come and attempt to barter with me, or you can buy carrots from me. But regardless, it is an inconvenient fact of life for you.

However, it is exactly the opposite for me. Since I can create carrots out of the ground, I just plant a seed, water the seed, and then exchange the carrot for gasoline.

America has managed to create a similar place for itself in an oil-dependent global economy. With oil priced in U.S. dollars, America can literally print money to buy oil… and then have the oil producers hold the debt that was created by printing the money in the first place.

What other nation, besides America, can print money to buy oil and then have the oil producers hold the debt for the printed money?

Obviously, the creation of the petrodollar system was a brilliant political and economic move. Washington was acutely aware in the early 1970's that the demand curve for oil would increase dramatically with time. Therefore, they positioned the dollar as the primary medium of exchange for all global oil transactions through the petrodollar system. This single political move created a growing international demand for both the U.S. dollar and U.S. debt — all at the expense of oil-producing nations.

For a very simplistic video explanation of the petrodollar system by Jerry Robinson, watch the video below…

How the Petrodollar System Has Affected U.S. Relations With Israel

Before we conclude, there is one politically sensitive topic that needs to be addressed that will help further clarify the true effects of the petrodollar system. Namely, how the petrodollar system has affected America's relationship with Israel.

If you were to ask most Americans today if the United States has been a close friend and ally of Israel, most would answer with a resounding "yes." This is especially true of Evangelical Christians who believe that America's foreign policy in the Middle East should be driven, and even dictated, by Israel. Evangelicals often side with Republican candidates who promise to "look out for" Israel and to "stand up for" Israel.

If you were to ask most Americans today if the United States has been a close friend and ally of Israel, most would answer with a resounding "yes." This is especially true of Evangelical Christians who believe that America's foreign policy in the Middle East should be driven, and even dictated, by Israel. Evangelicals often side with Republican candidates who promise to "look out for" Israel and to "stand up for" Israel.

But, is there any solid evidence that America's foreign policy measures, and actions in the Middle East have been guided by anything but upholding and protecting the petrodollar system?

I would strongly suggest that the answer is no.

Why is this important? Because I believe that the American population and Evangelicals in particular, have been hoodwinked with the "pro-Israel" chatter that pours out of most our political leader's mouths.

Instead of being a true friend and ally to Israel, I believe that America has cleverly used its "relationship" with the Jewish state as a cover for its military adventurism in the Middle East. (In our next article, I will suggest that most of the military action that America has taken in the Middle East has had more to do with protecting the petrodollar system and less to do with defending Israel.)

Still, many Americans, including most Evangelicals, buy the hype being pumped out of Washington's political spin rooms. If you turn off the corporate-controlled mainstream media for a day, however, and speak to the real inhabitants of the Middle East, a very different story emerges.

Would a true friend belittle your autonomy and self-determination by denying your right to defend yourself, all because they have made backroom deals with your enemies for financial gain?

Would a true friend seek to make you dependent upon financial aid and then give eight times more financial aid to your sworn enemies?

Yet, this is exactly what America has done to Israel in the name of "friendship."

When Israel seeks to defend her territory, America always rushes to prevent it.

Have you ever found yourself asking why America, and other Western interests who benefit from continued good relations with oil-producing nations, urge Israel to restrain herself? After all, who are we to intervene in a sovereign nation's foreign policy decisions?

Again, the truth is found when you follow the money…

As you may recall, part of the petrodollar agreement requires that the United States guarantee protection for Middle Eastern oil-producing nations from the threats specifically imposed by the Jewish state.

When dispensing foreign aid into the Middle East, does America give money exclusively to Israel and her allies? No.

Instead, Israel's sworn enemies receive eight times more in foreign aid than Israel does.

How can you give free money and weapons to the enemies of your so-called "best friend" and keep a straight face?

While the masses clamor at the feet of those leaders who profess "support for Israel," I would suggest that they have rarely stopped to ask what that American "support" really looks like?

The Jewish identity, as expressed in Zionism, is one that is deeply rooted in autonomy and self-determination.

It is my belief that America's so-called "support" for Israel has served as a crafty cover for maintaining a military presence in the region… all to protect our national interests.

America has attempted to play both sides of this Middle East game for far too long. And it has used the corporate-controlled media to control the American public for decades. They have kept us ignorant of the truth.

Keeping the Middle East inflamed and destabilized has been a stated goal of Western interests for decades. This is the name of the game when your goal is empire. And empires do not have friends… they have subjects.

It is time that Americans wake up and realize that we need to stop listening to the flapping jaws of the politicians and to the derelict corporate-controlled media, and instead, we should follow the money.

Maintaining the petrodollar system is the American empire's primary goal. Everything else is secondary.

READ PART THREE: The Petrodollar Wars: The Iraq Petrodollar Connection >>

<< Go Back to Part One: Preparing for the Collapse of the Petrodollar System

Get our Podcast Delivered Right in Your Inbox Every Tuesday

No spam guarantee!

TAGS: the petrodollar system, petrodollars, bretton woods, nixon shock, dollar collapse

Download it here absolutely free >> .

Preparing for the Collapse of the Petrodollar System, Part 3

The Petrodollar Wars: The Iraq-Petrodollar Connection

by Jerry Robinson

(Miss Part One and Two? Start here.)

| Introduction to Part Three: "The Petrodollar Wars" |

|---|

As we have learned from the previous articles in this series, the petrodollar system that was created in the 1970's has served America well, both economically and politically. What began as a way to drive more demand for the U.S. dollar in the wake of a move away from the international gold standard in 1971, has provided benefits that few could have ever imagined including the solidification of the U.S. dollar as the global currency of choice. This was important, especially following a temporary loss of dollar credibility after President Nixon's decision to close the gold window. Put simply, this 'dollars for oil' system has greatly enriched our nation. But this national prosperity has come at the expense of other nations and their potential prosperity. This brings us to one of the more sensitive, and therefore veiled, aspects of the petrodollar system. Namely, how it has impacted America's relations with foreign nations, especially in the Middle East. In this third installment of our series, I will explain how America has handled the growing international challenges to the petrodollar system. The consequences have been nothing short of tragic. I have entitled this piece The Petrodollar Wars. This article will focus specifically on the 2003 Iraq war. A follow-up article will detail the Petrodollar connection to the Afghanistan war, the Libyan war, and now, the build up to a war with Syria and Iran. |

The world currently consumes nearly 90 million barrels of oil per day.

According to some projections, global oil demand will reach well over 100 million barrels per day by 2015. And thanks to the petrodollar system, growing global demand for oil leads to an increase in U.S. dollar demand. This artificial demand for U.S. dollars has provided remarkable benefits for the U.S. economy. It has also required the Federal Reserve to keep the dollar in plentiful supply.

By perpetually expanding the U.S. money supply, America's standard of living increases as well. (If this logic does not make sense, be sure to go back and read Part One of this series.) The problem with this situation is that the only way that it can be sustained is if the demand for the dollar and for U.S. debt securities remains consistently strong.

Grasping this last point is extremely important. For if the artificial global dollar demand, made possible by the petrodollar system, were ever to crumble, foreign nations who had formerly found it beneficial to hold U.S. dollars would suddenly find that they no longer needed the massive number that they were holding. This massive number of dollars, which would no longer be useful to foreign nations, would come rushing back to their place of origin… America.

Obviously, an influx of dollars into the American economy would lead to massive inflationary pressures within our economic system.

It is difficult to overstate the importance of this concept as the entire American monetary system hinges on this "dollars for oil" system. Without it, Washington would lose its permission slip to print excessive numbers of dollars.

Therefore, it should come as no surprise that America has a vested interest in maintaining the petrodollar system. And, if you are an American citizen, so do you.

So… What Would Happen If The Petrodollar System Ended Tomorrow

Allow me to briefly explain the impact that a sudden loss of the petrodollar system would have upon the United States of America.

- Foreign nations would begin sending a flood of U.S. dollars back to the United States in exchange for the new currency needed for oil.

- The Federal Reserve would lose their ability to print more dollars to solve America's economic problems.

- The Treasury Secretary and the Federal Reserve Chairman would meet to determine the best course of action.

- That action would involve an immediate and dramatic increase in interest rates to reduce America's money supply.

- Hyperinflation would ensue temporarily while the interest rates took time to take full effect.

- All oil-related prices, including gas prices, would reach outrageous levels.

- Washington would soon realize that the total amount of money in the system would have to be dramatically slashed even further, leading to an even higher increase in interest rates.

- The clueless American public would demand answers. Those on the left would blame the right. The right would blame the left. And both political parties would seek to blame the Federal Reserve.

- People with adjustable rate debts would be crushed and massive layoffs would occur as businesses suffered from the high interest rates.

- Asset prices across the board would plummet in value.

- Amid the financial carnage, an economic recovery eventually would begin to take place. But this new American economy would be tremendously smaller due to a drastically reduced money supply.

This brief scenario is far from exhaustive and is probably very incomplete. But I provide it to help you understand the great economic damage that you and I, and our nation in general, would sustain if the petrodollar system were to collapse suddenly.

The Washington elites are intimately aware of how serious the economic situation could become if the petrodollar system collapsed. After all, they were the architects and masterminds of the entire system. And if one considers Washington's policies since the mid-1970's, it is evident that they have no intention of allowing the petrodollar system to fail.

America – The Primary Guardian of the Petrodollar System

Since the dawn of the petroleum age, the geopolitical strategies concocted by developed nations have increasingly been centered on maintaining easy access to the world's oil supplies. Only the truly naive could deny the obvious powerful economic and political incentives that are derived from access to cheap oil supplies. And while most nations have a clear motivation to maintain easy access to the world's cheapest oil supplies out of sheer economic necessity, as well as the political goodwill it engenders among the masses, this is certainly not the sole concern for the United States. As you have discovered, the United States has an additional unique incentive regarding the world's oil. Namely, ensuring that all oil around the globe, both current supplies and future discoveries, remain priced in U.S. dollars.

In 1973, in the wake of U.S. military involvement in the Vietnam War, Washington began turning its attention to another region of the globe: the Persian Gulf. The Yom Kippur War gripped the oil-rich area. After the ensuing 'oil shock' of 1973, President Richard Nixon warned U.S. citizens "that American military intervention to protect vital oil supplies" in the region was a strong possibility. This speech marked the first official and formal commitment to deploy U.S. troops to the Middle East for the explicit reason of protecting America's oil interests.

In 1973, in the wake of U.S. military involvement in the Vietnam War, Washington began turning its attention to another region of the globe: the Persian Gulf. The Yom Kippur War gripped the oil-rich area. After the ensuing 'oil shock' of 1973, President Richard Nixon warned U.S. citizens "that American military intervention to protect vital oil supplies" in the region was a strong possibility. This speech marked the first official and formal commitment to deploy U.S. troops to the Middle East for the explicit reason of protecting America's oil interests.On January 1, 1983, Carter's Rapid Deployment Force morphed into a separate force known as the United States Central Command (USCENTCOM). USCENTCOM would be responsible for the Middle East and Central Asian regions.

Since 1980, the U.S. has feverishly built military bases all over Western Asia.

Understanding the petrodollar system will help you make sense of the hundreds of U.S. military bases stationed in over 130 countries. After all, maintaining an empire dependent upon a "dollars for oil" system is no cheap task and requires careful monitoring and oversight of the world's oil supplies. Chief among the potential concerns for the petrodollar guardians are: threats of restrictions on oil supplies, new oil discoveries in potentially "anti-Western" oil fields, the nationalizing of a country's oil supplies, and perhaps most importantly, devising "permanent solutions" to the problems presented by nations who dare challenge the current "dollars for oil" system.

As the primary guardian of the petrodollar, the U.S. often finds its militaristic adventurism at odds with the goals of foreign nations who do not share the same enthusiasm for confronting sovereign nations over a system in which they share no real direct incentives.

Given these facts, let's now explore how the petrodollar system has affected America's foreign policy actions in the oil-rich region of Western Asia. We will begin with a look back at the events of America's darkest hour.

Beating the Iraq War Drums – Before 9/11

On September 11, 2001, America's relations with the Middle East would be altered forever.

The tragic events of that day still live on in the memory of every American. The dreadful carnage in New York City, Washington D.C., and Shanksville, Pennsylvania was heart-rending to the billions around the world who watched the terror unfold before their eyes on live television.

When reports later came in that three of the hijackers involved in the 9/11 attacks were connected to Al Qaeda, Rumsfeld reportedly became so determined to find a rationale for an attack on Iraq that "on 10 separate occasions he asked the CIA to find evidence linking Iraq to the terror attacks of Sept. 11." The CIA repeatedly came back empty-handed.

"The president in a very intimidating way left us, me and my staff, with the clear indication that he wanted us to come back with the word there was an Iraqi hand behind 9/11 because they had been planning to do something about Iraq from before the time they came into office. I think they had a plan from day one they wanted to do something about Iraq. While the World Trade Center was still smoldering, while they were still digging bodies out, people in the White House were thinking: 'Ah! This gives us the opportunity we have been looking for to go after Iraq.'"

On September 17, six short days after the 9/11 attacks, President George W. Bush named Osama Bin Laden as the "prime suspect" in the biggest terrorist act on American soil in history. Washington's response was swift.

On October 7, 2001, Operation Enduring Freedom was launched. Thousands of U.S. troops were sent into the mountainous regions of Afghanistan. Washington's stated goal in this mission was clear: To capture Bin Laden, and to wipe out two groups intimately connected to him: Al Qaeda and the Taliban.

But the Bush Administration had no plans of allowing a good crisis to go to waste. While they had succeeded in their initial invasion plans of Afghanistan, Iraq was still at the forefront of the Administration's collective mind. Within a few short weeks after the Afghanistan war had begun, Washington began using the corporate-controlled mainstream media to build their case for a full-scale invasion of Iraq.

In the build-up to a separate war, U.S. officials began publicly claiming that Iraq, and its maniacal dictator Saddam Hussein, presented an entirely separate set of national security threats, despite the fact that no legitimate evidence linked Bin Laden to the country of Iraq. Despite this astounding lack of evidence, the Bush Administration continued to whip the American public into a war-crazed frenzy with unfounded claims of Iraq's alleged development and possession, of weapons of mass destruction. In addition, Iraq's intimate ties to international terrorist groups were highlighted and hypnotically repeated, through the mainstream media outlets.

A deeply wounded post 9/11 America desperately sought answers and justice. In the moment of their deepest grief and fear, the Washington elites manipulated the masses to promote their desired foreign policy measures.

All of the stops were pulled out. Conservative radio and television talk show hosts began reading the Bush talking points verbatim over the air, warning the already fearful American public of the tremendous threats that Iraq posed to our national security.

It did not take long for America to become sharply divided on Washington's hasty insistence on launching another war in the volatile region of the Middle East. And while the majority of the American public supported a full-scale invasion of Iraq, others urged a more diplomatic approach.

But in the wake of the devastation of 9/11, few were in the mood for diplomacy.

As the war drums over Iraq beat ever so loudly, legitimate questions concerning the merits of the war required Washington to provide specific answers to a confused and terror-weary public.

Some of those pressing questions included:

Was there proof that Iraq had plans to harm the American people or to invade the borders of our nation?

Was there solid evidence that Iraq had weapons of mass destruction?

And, was there any evidence linking Iraqi president Saddam Hussein to the vicious terror plot of 9/11?

The Bush Administration and the corporate-controlled mainstream media wasted no time in answering those difficult questions with a resounding and overly confident "yes."

The Iraq-Petrodollar Connection

So why Iraq? Why the rush to war with a country that so obviously had no connection with the events of 9/11?

As I write this in the early part of 2012, it is a safe assumption that most Americans carry a suspicion, however slight, toward the reasons that they were told the U.S. needed to invade Iraq back in 2003. It is simply not possible to explain the depths of the corruption that exist at the highest levels of government today. Those who have bought into the mainstream media's portrayal of the American government as an institution who seeks the common good, they do well to recall the words of America's own first national leader:

"Government is not reason; it is not eloquent; it is force. Like fire, it is a dangerous servant and a fearful master." (President George Washington)

With that quote as a backdrop, let us dig deeper into our original question: Why did the U.S. appear so eager to launch an unprovoked war against Iraq? And why did the U.S. begin hatching these war plans many months prior to the events of September 11?

After all, many other nations around the world have confirmed stockpiles of dangerous weapons. So why did the United States specifically target Iraq so soon after the Afghanistan invasion of 2001?

Did the U.S. have some other motivation for seeking international support to invade Iraq?

According to research conducted by both Clark and Engdahl, the U.S.-led invasion of Iraq was not exclusively motivated by Iraq's connection to the terrorist groups who masterminded the 9/11 attacks. Nor was it out of concern for the safety of the American public or out of sympathy for the Iraqi people and their lack of freedom or democracy.

Instead, Clark and Engdahl both claimed that the U.S.-led invasion was inspired predominantly by Iraq's public defiance of the petrodollar system.

According to page 28 of Clark's book:

"On September 24, 2000, Saddam Hussein allegedly "emerged from a meeting of his government and proclaimed that Iraq would soon transition its oil export transactions to the euro currency."

Clark comments on the limited media coverage on page 31 of his book:

"CNN ran a very short article on its website on October 30, 2000, but after this one-day news cycle, the issue of Iraq's switch to a petroeuro essentially disappeared from all five of the corporate-owned media outlets."

By 2002, Saddam had fully converted to a petroeuro – in essence, dumping the dollar.

On March 19, 2003, George W. Bush announced the commencement of a full scale invasion of Iraq.

According to Clark and Engdahl, Saddam's bold threat to the petrodollar system had invited the full force and fury of the U.S. military onto his front lawn.

Was the Iraq war really about weapons of mass destruction, al-Qaeda, fighting terrorism, and promoting democracy?

Or was America's stated purposes to "liberate" the Iraqi people from a brutal regime actually a clever guise for making an example of a nation who dared threaten the existing petrodollar system?

I am not a Washington elite. And I do not claim to know the minds of men. However, the more that you consider all the facts, you will find that the invasion of Iraq was likely one of the first in a series of "petrodollar wars" designed to protect America's economic interests.

It should be noted that Iraq's proven oil supplies are considered to be among the largest in the world. Some experts believe that Iraq's oilfields, many of which have yet to be exploited, will catapult Iraq above Saudi Arabia in total proven oil reserves in the coming years.

What's "Our" Oil Doing Under "Their" Sand?

Washington, of course, adamantly denied any and all accusations that the Iraq war was motivated by anything other than disarming Iraq and liberating its beleagered people. According to the Washington elites, the Iraq war was not, nor was it ever, about Iraqi's oil supplies.

Consider a small sampling of quotes from U.S. officials:

"The idea that the United States covets Iraqi oil fields is a wrong impression. I have a deep desire for peace. That's what I have a desire for. And freedom for the Iraqi people. See, I don't like a system where people are repressed through torture and murder in order to keep a dictator in place. It troubles me deeply. And so the Iraqi people must hear this loud and clear, that this country never has any intention to conquer anybody."

(U.S. President George W. Bush)

"This is not about oil; this is about a tyrant, a dictator, who is developing weapons of mass destruction to use against the Arab populations."

(U.S. Secretary of State Colin Powell)

"It's not about oil and it's not about religion."

(U.S. Secretary of Defense Donald Rumsfeld)

"I have heard that allegation (of oil motives) and I simply reject it."

(Coalition Provisional Authority Paul Bremer)

"It's not about oil."

(General John Abizaid, Combatant Commander, Central Command)

"It was not about oil."

(Energy Secretary Spencer Abraham)

"It's not about the oil."

(the Financial Times reported Richard Perle shouting at a parking attendant in frustration.)

"This is not about oil."

(Australian Treasurer Peter Costello)

"The only thing I can tell you is this war is not about oil."

(Former Secretary of State Lawrence Eagleburger)

"This is not about oil. This is about international peace and security."

(Jack Straw, British Foreign Secretary)

"This is not about oil. That was very clear. This is about America, and America's position in the world, as the upholder of liberty for the oppressed."

(Utah Republican Senator Bob Bennett)

"There's just nothing to it."

(White House spokesperson Ari Fleischer on the U.S. desire to access Iraqi oil fields.)

Condoleeza Rice, in response to the proposition, "if Saddam's primary export or natural resource was olive oil rather than oil, we would not be going through this situation," said:

"This cannot be further from the truth. He is a threat to his neighbors. He's a threat to American security interest. That is what the president has in mind." She continued: "This is not about oil."

The government line was loud and clear: The Iraq war was not about oil.

Or… Is it About the Oil?

Despite the adamant denial by the Washington elites that their intentions were anything but pure, it did not take long for dissenters to emerge. Anti-war demonstrations filled the public squares of nearly every American town.

Interestingly, as the war with Iraq raged on, even those within Washington began to make revealing comments on the U.S.-Iraq-Oil connection.

In June 2003, Deputy Defense Secretary Paul Wolfowitz made the following comments after being asked why Iraq was being treated differently than North Korea on the question of a nuclear threat, while speaking to an Asian security summit in Singapore:

"Let's look at it simply. The most important difference between North Korea and Iraq is that economically, we just had no choice in Iraq. The country swims on a sea of oil."

In an August 2008 interview with BusinessWeek magazine, Republican Vice-Presidential candidate Sarah Palin stated:

"We are a nation at war and in many [ways] the reasons for war are fights over energy sources, which is nonsensical when you consider that domestically we have the supplies ready to go."

During a 2008 Townhall campaign meeting, former Presidential candidate and Senator, John McCain, made the following statement:

"My friends, I will have an energy policy which will eliminate our dependence on oil from the Middle East and will then prevent us from having ever to send our young men and women into conflict again in the Middle East."

"I am saddened that it is politically inconvenient to acknowledge what everyone knows: the Iraq war is largely about oil."

"I have been a member of four (Presidential) administrations. And in every one of those administrations we had written as a national security policy that we would go to war to protect the national energy reserves of the Persian Gulf, if necessary."

"Of course (the Iraq war) is about oil, we can't deny that."

"The critical oil and natural gas producing region that we fought so many wars to try and protect our economy from the adverse impact of losing that supply or having it available only at very high prices."

Q: Do you think the U.S. or U.N. forces, should have moved into Baghdad?

A: No.

Q: Why not?

A: Because if we'd gone to Baghdad we would have been all alone. There wouldn't have been anybody else with us. There would have been a U.S. occupation of Iraq. None of the Arab forces that were willing to fight with us in Kuwait were willing to invade Iraq. Once you got to Iraq and took it over, took down Saddam Hussein's government, then what are you going to put in its place? That's a very volatile part of the world, and if you take down the central government of Iraq, you could very easily end up seeing pieces of Iraq fly off: part of it, the Syrians would like to have to the west, part of it — eastern Iraq — the Iranians would like to claim, they fought over it for eight years. In the north, you've got the Kurds, and if the Kurds spin loose and join with the Kurds in Turkey, then you threaten the territorial integrity of Turkey. It's a quagmire if you go that far and try to take over Iraq. The other thing was casualties. Everyone was impressed with the fact we were able to do our job with as few casualties as we had. But for the 146 Americans killed in action, and for their families — it wasn't a cheap war. And the question for the president, in terms of whether or not we went on to Baghdad, took additional casualties in an effort to get Saddam Hussein, was how many additional dead Americans is Saddam worth? Our judgment was, not very many, and I think we got it right."

Let's take a look at what has transpired in the aftermath of the U.S.-led invasion of Iraq to see if the words and the actions line up.

The Rush for Post-War Iraqi Oil

In late 2002 and early 2003, the preparations for the Iraq war were well under way.

As the United States sought international support for the war, several nations expressed opposition to the invasion. China, Russia, and France were among these nations.

Many in the corporate-controlled American media portrayed these nations as "sympathizers" and "supporters" of terrorism due to their hesitancy to invade Iraq on groundless charges.

However, what the corrupt media outlets failed to mention was that these nations had existing oil contracts with Iraq that would be endangered in the event that the West gained control of Iraq.

In an October 2002 interview with the Observer UK, a Russian official at the United Nations stated:

"The concern of my government is that the concessions agreed between Baghdad and numerous enterprises will be reneged upon, and that U.S. companies will enter to take the greatest share of those existing contracts. . . . Yes, if you could say it that way — an oil grab by Washington."